advantages and disadvantages of llc for rental property

Most will not approve. Here are some of the reasons certain investors and landlords choose to stay away.

Llc For Property Rentals Pros Cons Of Llc For Rental Property

An LLC is the American form of a private limited company.

. List of the Cons of Using an LLC for a Rental Property 1. There are many advantages to establishing an LLC for your rental properties. It Costs Money to Register an LLC for Single Family Rental Properties The aforementioned benefits come at a cost.

Benefits Of An LLC Limited Liability Company Forming An LLC. Save Time and Money by Creating and Downloading Any Legally Binding Agreement in Minutes. If your LLC is named in a lawsuit involving your property the.

Skip to content Menu Close. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. Youll need to pay.

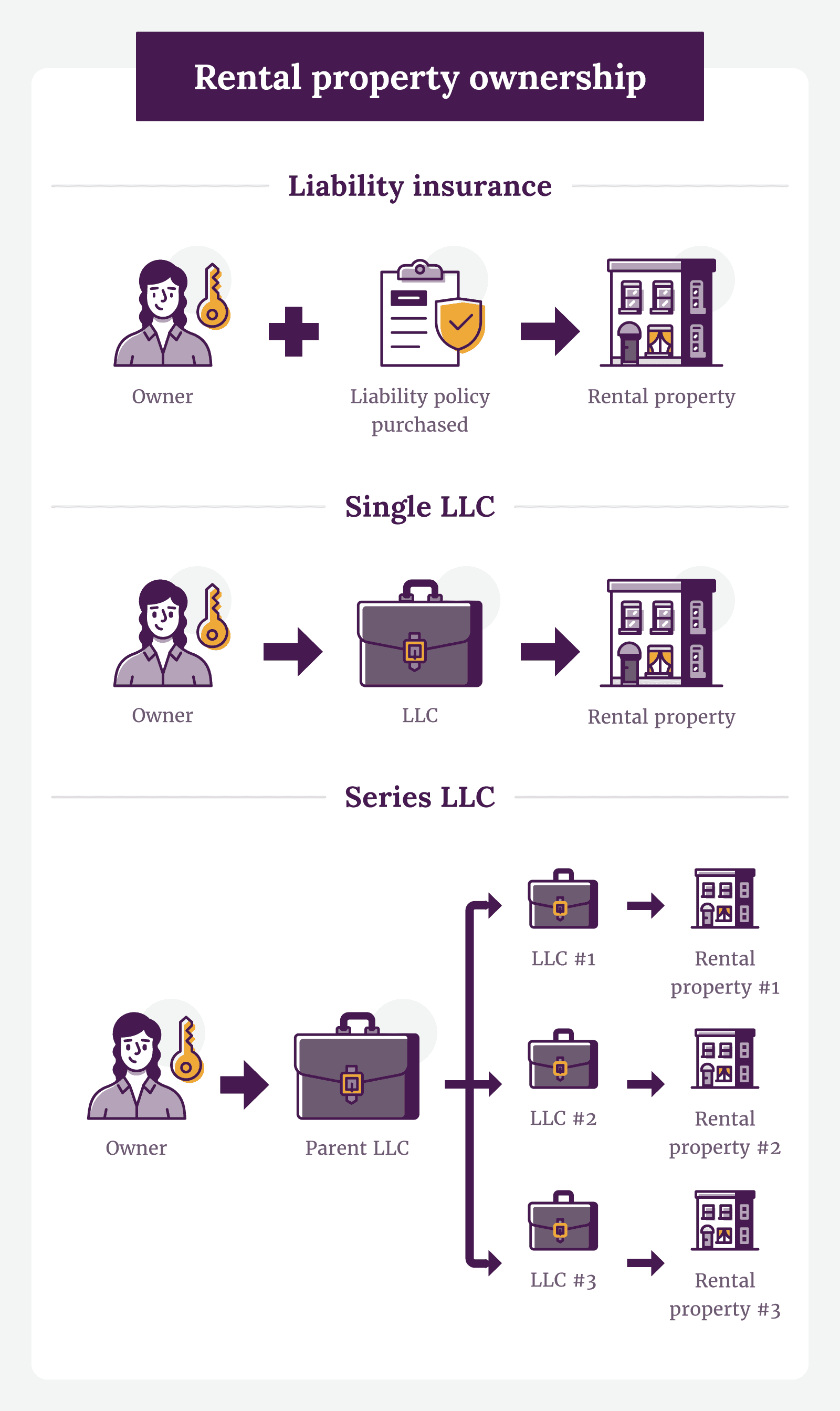

If you operate rental properties with only liability insurance and do not form a business your. Buying a rental property as an LLC often requires more in fees a. The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline.

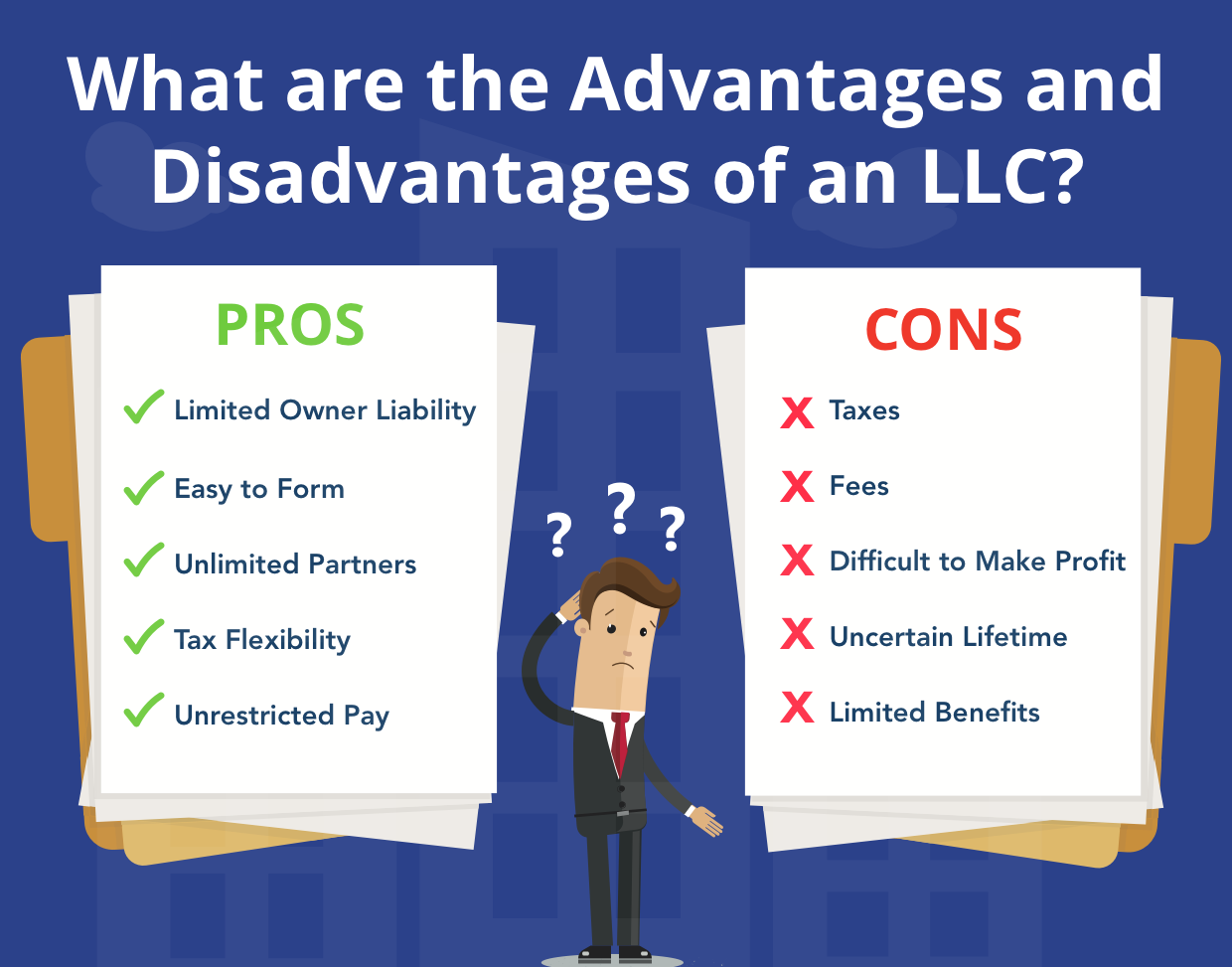

There are various fees involved with setting up and maintaining an LLC which will vary by state. What are advantages and disadvantages of LLC Limited Liability Company. If rental properties are part of your investment portfolio then.

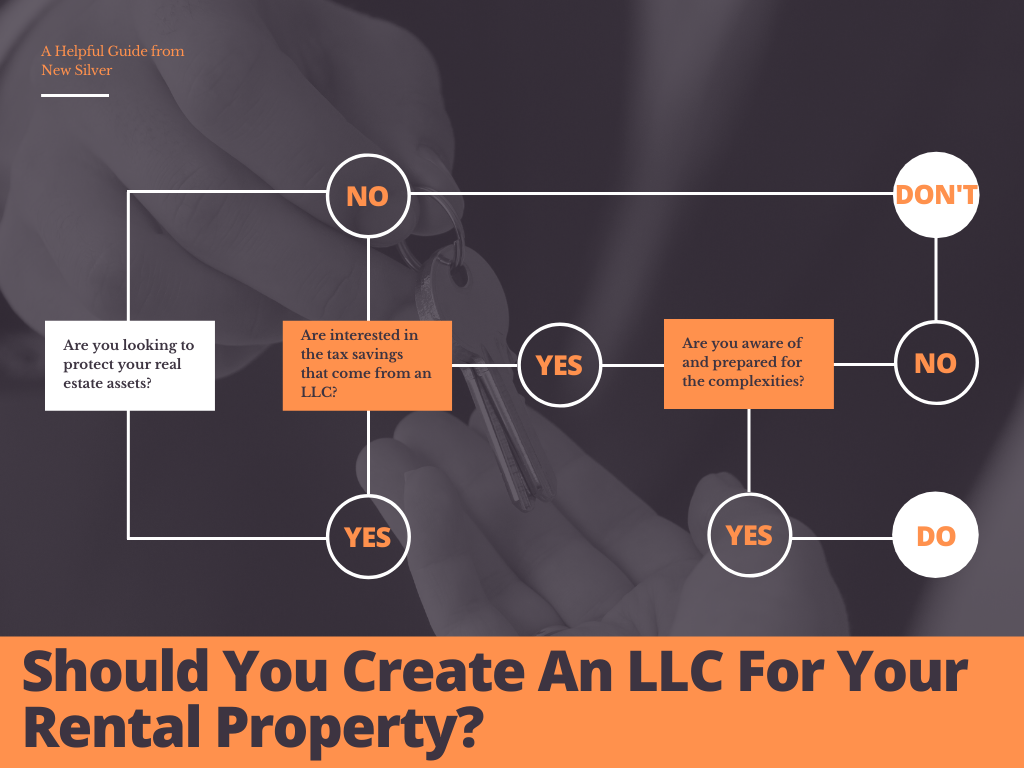

Banks and lenders are funny when it comes to LLCs. Here are some of the benefits of investing in rental properties. As stated above the main benefit of forming an LLC is personal liability protection.

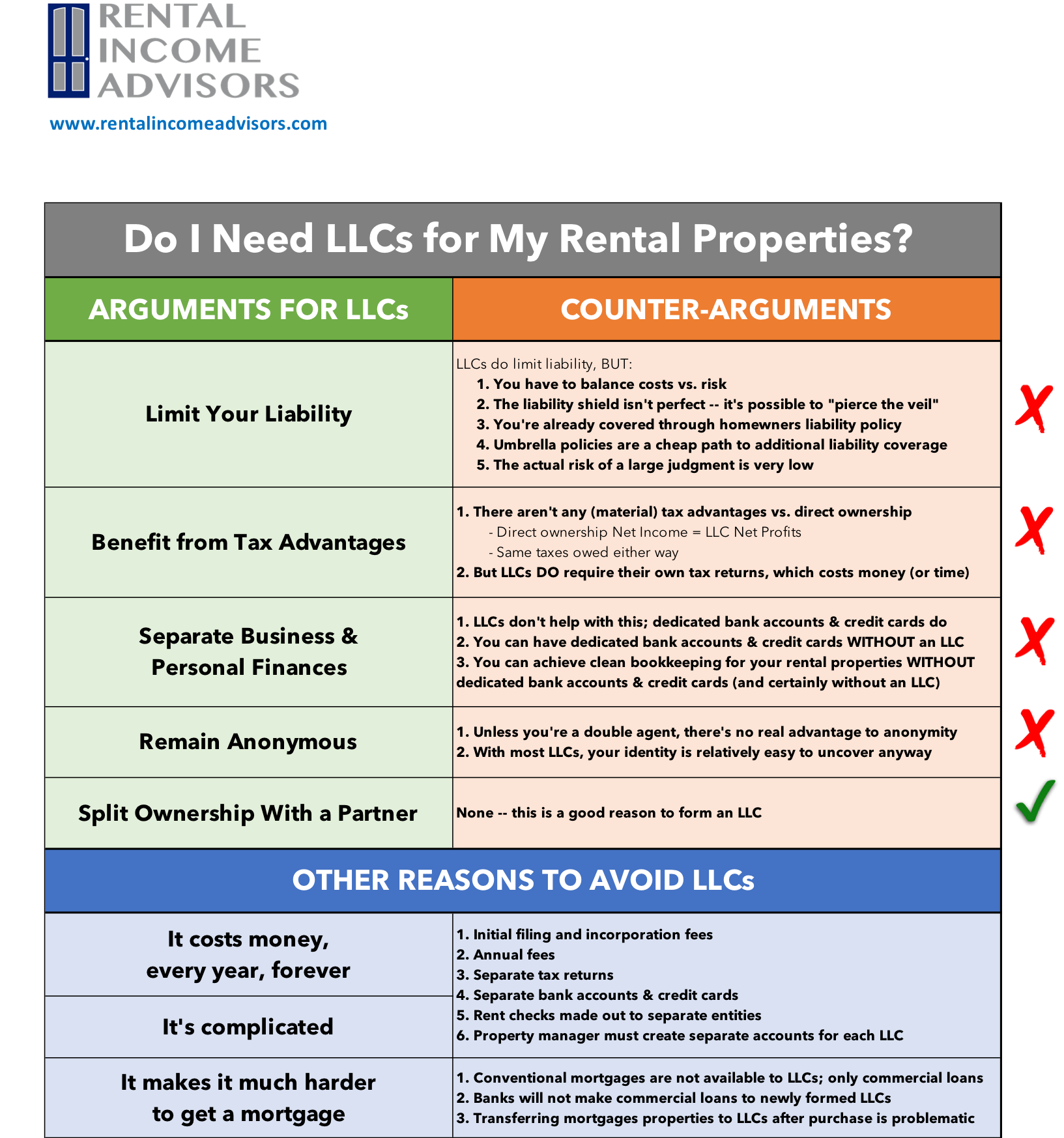

The Advantages and Disadvantages of titling your Rental Properties into an LLC. Advantages of a Series LLC for Real Estate Investments. Three advantages to using an LLC for rental property.

Understanding LLC Disadvantages. Compare the Best Registered Agent Services and Let the Experts Do The Paperwork. The limited liability companys structure is similar to a corporation protecting the LLC owners from being personally pursued for LLC obligations.

This is the dream that most people have when. Sometimes clients will come in and they have a scenario of owning multiple rental properties maybe 20 to 30 rental houses. 9 Growth of the LLC Real Estate Rental and Development LLCs first were used primarily for.

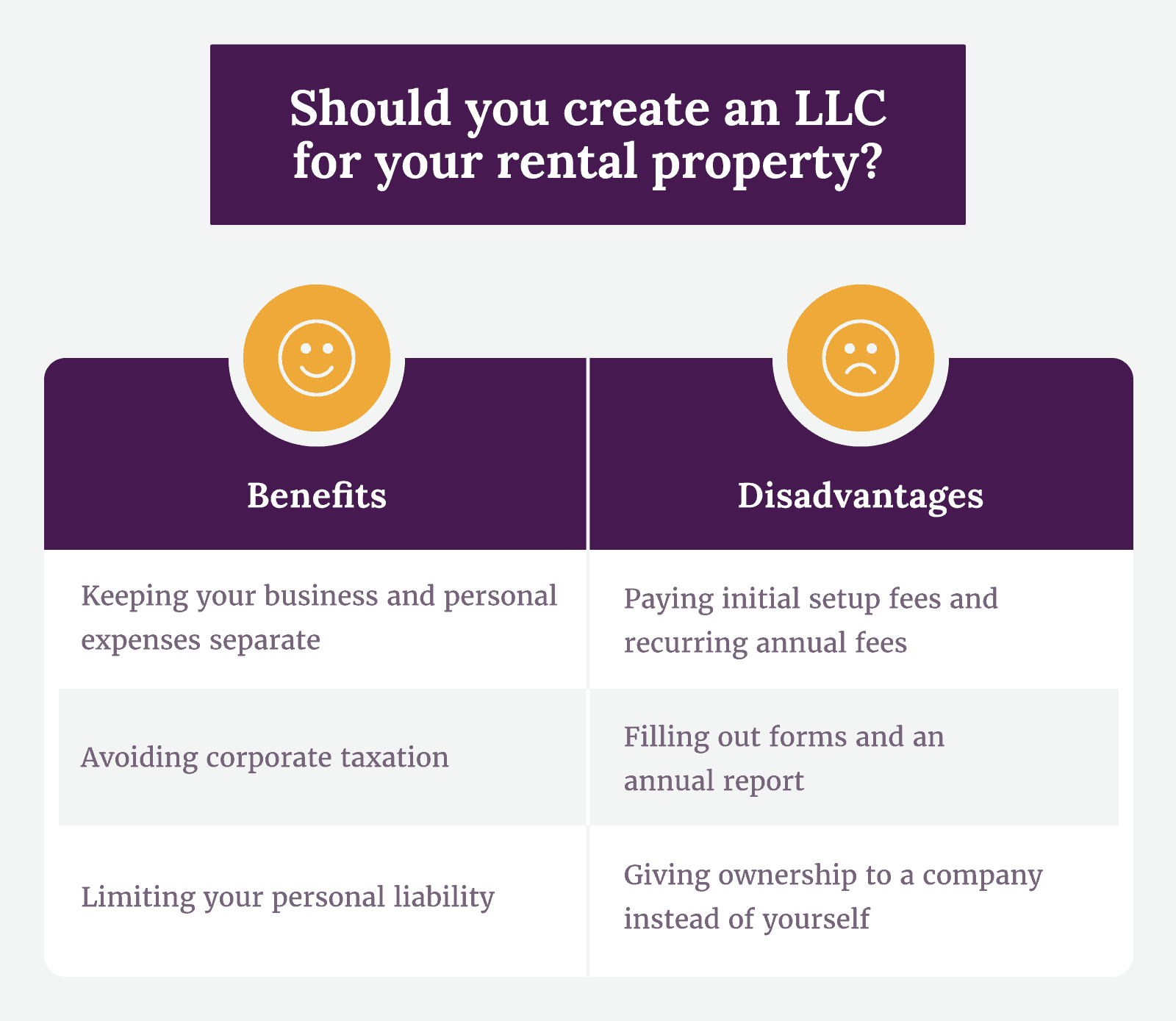

Ad Start an LLC and protect your personal assets. Pros of an LLC for rental property 1. Advantages and Disadvantages of an LLC for Rental Property Another advantage of setting up an LLC for rental property is that it allows you to claim.

There are limits to the protections an LLC provides. Limited Liability Form An LLC Benefits Of An LLC more. While there are many benefits to creating an LLC there are also quite a few drawbacks that might mean its not the best option for every property owner.

Generally like a sole proprietorship or a partnership an LLC isnt considered a. Depending on your specific situation and unique circumstances the following may be considered pros for. Ad Create Your Business Plan Online.

One of the disadvantages of using an LLC for a real estate rental business is the cost. Protect personal assets Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. We offer services to help keep your LLC compliant like federal tax IDEIN licenses.

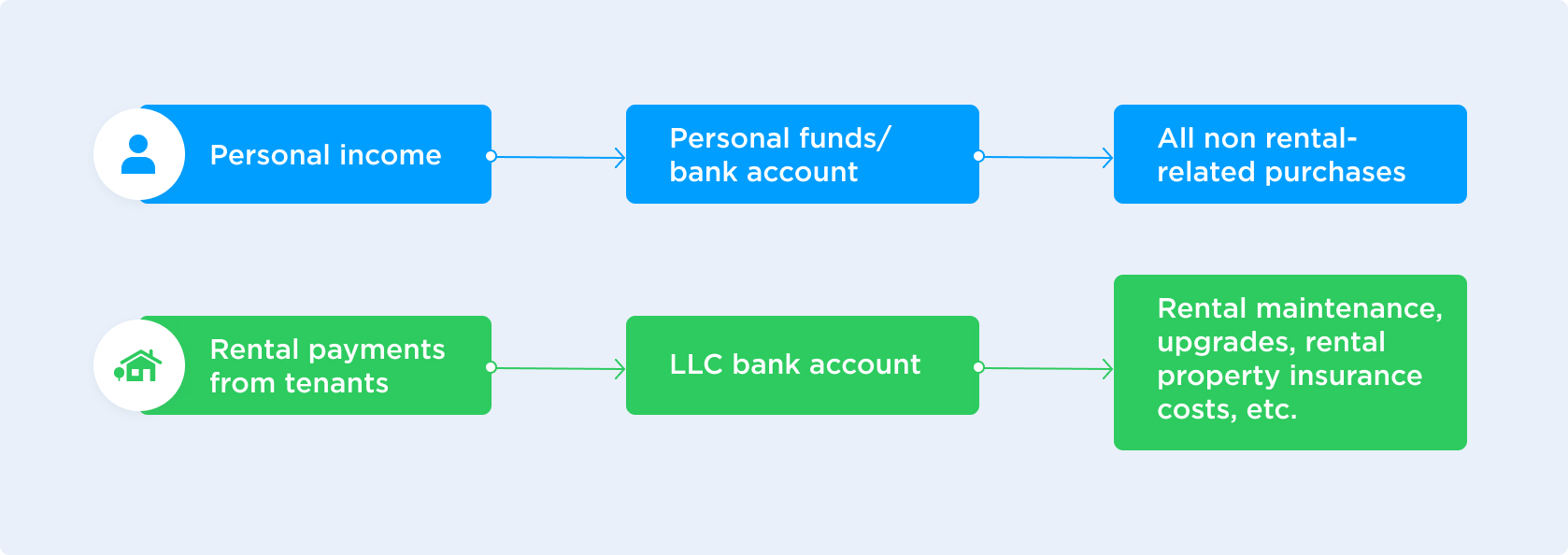

While there are some benefits to buying a rental property through an LLC there are also some drawbacks. The advantages and disadvantages to owning rental property in an LLC Real estate investors -just like every business owner- need to track their income and expenses so that. Ad See How Easily You Can File an LLC in Your Desired State With These LLC Formation Services.

A public company as opposed to a limited company issues shares of stock ownership that can be publicly traded on a. Advantages of Rental Properties. Lets cover the first most obvious advantage of a real estate LLC.

Need to form 20 or 30 separate LLCs to get the benefits of. Limited liability for real estate investors. An intangible benefit of owning and holding real estate in the name of an LLC is that it appears to the public to be more professional especially when.

We Know Youre Busy - Weve Created The Simplest Way To Launch Your LLC. With any real estate investment a real estate investor is taking on risk. The main reason investors prefer to have their rental properties in an LLC is for.

Tom Marilyn and Beanna. We offer services to help keep your LLC compliant like federal tax IDEIN licenses. Occasionally a rental property owner will be convinced they need to put their rental property into an LLC be it single owner or multi-owner LLC as a means of protecting themselves and their.

We can help you get started. Ad Start an LLC and protect your personal assets. Ad We Researched It For You.

Keeping your business and personal. We can help you get started. Real Estate Taxation with Representation LLC has deduction for rent.

Here are the three potential drawbacks of this solution. Ad Form An LLC And Stay Covered All Year With Worry Free Services Support.

Llc In Real Estate Pros And Cons Nestapple New York

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Should I Start An Llc Do I Need An Llc Truic

How To Use An Llc For Rental Property

Fsbo Right Or Wrong Tour Wizard Beach House Vacation Real Estate Photographer Beautiful Buildings

Should You Create An Llc For Rental Property Pros And Cons New Silver

12 Reasons To Use An Llc For Rental Property Under 30 Wealth

Llc For Rental Property What Should Real Estate Investors Do

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Should You Put Your Rental Property In An Llc Truic

20 Pros And Cons Of Creating An Llc For Your Rental Property

Pin On Harris County Appraisal

Rental Property Llc Tax Benefits Pros Cons Of Using An Llc For Real Estate Youtube

Llc For Rental Property Pros Cons Explained Simplifyllc

Five Advantages Of Real Estate Investment Property Valuation Property Management Real Estate

Llc For Rental Property Pros Cons Explained Simplifyllc

Should You Put Rental Properties In An Llc White Coat Investor